More Courageous Bets and Equitable Returns:

Challenging Perceptions about Public Investment in Innovation

Starting a Different Conversation

What makes smart, equitable, and innovation-led economic growth possible? Very few Canadians would answer, “A more active role for government.”

We’ve been told that innovation is the work of bold entrepreneurs and venture capitalists. Governments are regulators, too timid and slow by design. They should simply get out of the way.

“Ignoring the key role of the state — or the taxpayer — in wealth creation has been a lead cause of inequality, allowing some (hyped up) actors to reap a rate of return way beyond their actual contribution.”

Stories about the dynamic, competitive private sector and the lethargic, bureaucratic public sector have shaped our perceptions and dominated our civic conversations for decades. There is a growing body of evidence, however, that challenges these perceptions. It posits a different narrative about who deserves credit for innovation and to be rewarded for taking well-calculated risks. It casts government in the role of courageous investor and deliverer of more equitable returns. It raises our expectations of the public sector instead of dampening them.

U.K. economist Mariana Mazzucato is a leader in the field of challengers to the traditional narrative. She holds the RM Phillips Chair in the Economics of Innovation at SPRU in the University of Sussex. Her latest book, The Entrepreneurial State: Debunking Private vs. Public Sector Myths, focuses on new frameworks for understanding the role of government in economic growth, innovation, and financial markets.

Mazzucato’s research reveals the significant role that governments have played in some of the biggest breakthroughs in the past half-century, shaping and creating new markets in which businesses thrive today — from the Internet to information technology (IT), from bio and nano to green technology. It also shows how the risks associated with innovation are socialized while the rewards are privatized.

“Ignoring the key role of the state — or the taxpayer — in wealth creation has been a lead cause of inequality, allowing some (hyped up) actors to reap a rate of return way beyond their actual contribution.”

“Ignoring the key role of the state — or the taxpayer — in wealth creation,” Mazzucato argues, “has been a lead cause of inequality, allowing some (hyped up) actors to reap a rate of return way beyond their actual contribution.”i This conclusion is a starting point for a very different conversation about what Canadians can expect from their governments — one that considers the appropriate balance between driving and supporting innovation, picking market winners and fixing failures, and taking and benefiting from risk.

This conversation starter aims to challenge inaccurate or incomplete perceptions about public investment in innovation. It also aims to engage a wide cross-section of Canadians — leading citizens, businesses, policymakers, academics, and everyone who cares about the country’s future — in asking questions about the kind of government we need for the kind of economic growth we want in the first half of this century. It assumes that the current levels of income and wealth inequality are unacceptable, and that a more active role for government is required to reduce them.

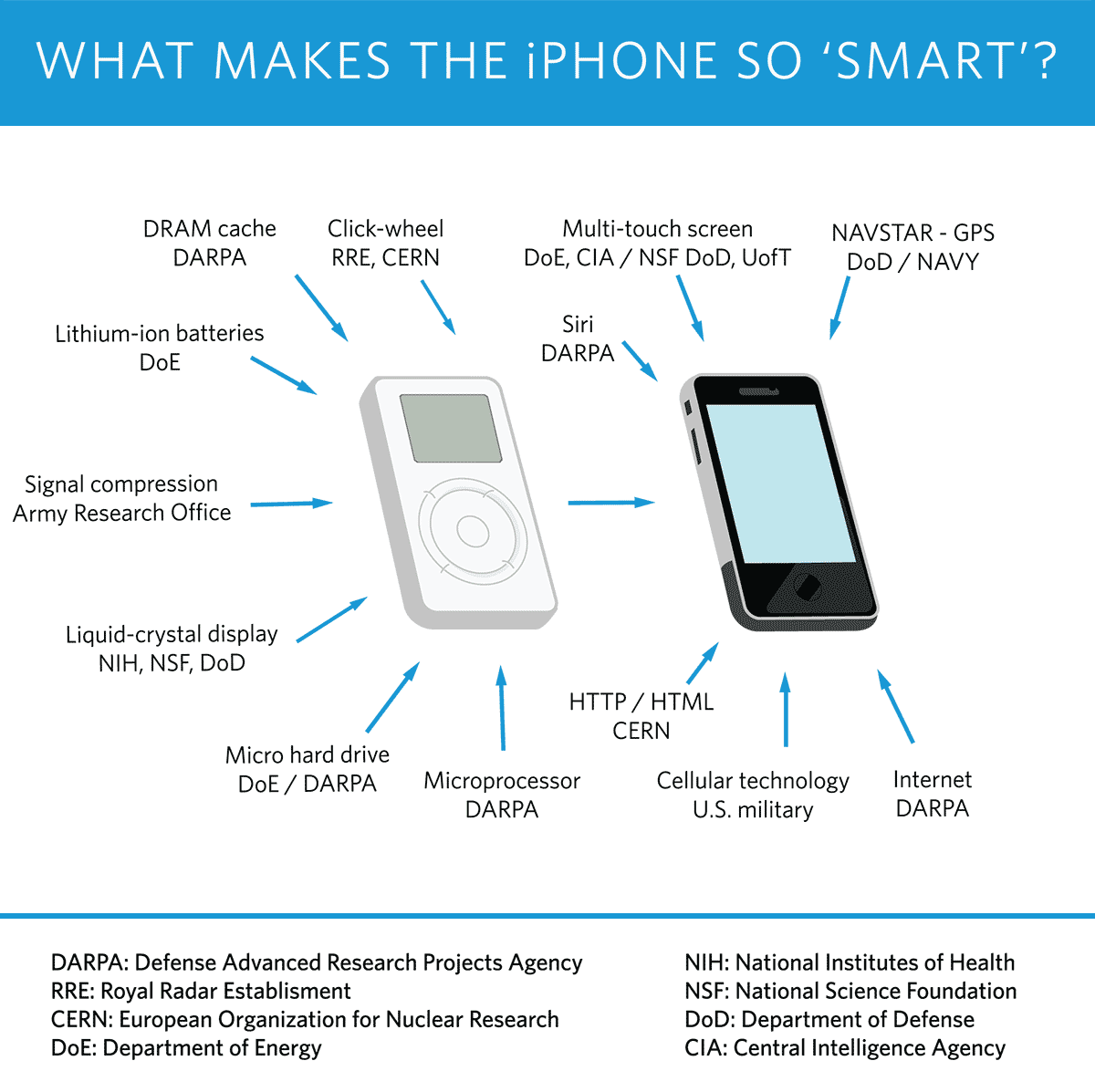

If you are reading this document from your iPhone or found it through a Google search, you can thank the enterprising government investors who came alongside others to make these innovations possible.

If you, too, want more courageous bets like these, but you want more from them next time, read on to learn what we have to do.

Challenging Perceptions

What comes to mind when you think of “start-ups”?

Perhaps you envision a group of jean- and plaid-wearing employees gathered around their iMacs in a loft-style office, coding the next software update for their latest app. Maybe you picture a dynamic new company that employs highly skilled workers and creates exciting new products.

Now consider the word “government.” The image conjured up is likely different — perhaps professionally dressed employees working on desktop computers in cubicles, inside a large office building.

These images have some basis in reality. However, there are economists who argue that this characterization of the government is incomplete and has been used as justification to cut, attack, dismantle, and privatize government institutions and public services.

While innovation is certainly not the government’s main focus, Mazzucato’s latest body of work argues that the visible hand of the state, not the invisible hand of the free market, is responsible for the breakthroughs that define these times.

To understand the role government can play, it’s helpful to first consider two persistent myths about “meddlesome” politicians and public servants:

1. “The market should be left alone.”For decades, government intervention in the market has fallen out of favour, at least in mainstream political and economic circles. Government, we’re reminded daily, should not be in the business of supporting certain industries over others.

In practice, governments around the world have long targeted industries and region-specific sectors for support, taking advantage of local networks or industry “clusters” and their resources and expertise (Ciuriak and Curtis, 2013; Creutzberg, 2011). Indeed, the industries that dominate the market today — like the oil sands in Alberta or the automotive industry in Ontario — are often the result of previous government activity and massive investments that established a market or strengthened a comparative advantage. Government and the industrial incumbents often forget or downplay this reality.

In the wake of the Great Recession of 2008–2009, the resurgence of industrial policy — government policies directed at affecting the economic structure of the economy — has been evident around the world (Stiglitz and Yifu Lin, 2013; Ciuriak and Curtis, 2013). A heightened focus on science, technology, and innovation policies has also emerged, with governments looking for ways to bridge the gap between scientific research and discoveries on the one hand, and their commercial applications on the other (Council of Canadian Academies, 2013b).

There are myriad ways that governments make industrial, science, and technology policy (Ciuriak and Curtis, 2013; PricewaterhouseCoopers, 2010).ii And by acting to grow and nurture domestic industries, governments are, in a sense, always picking winners.

It’s helpful to consider a recent example. In 2010, Tesla Motors — run by one of Silicon Valley’s most celebrated, “self-made” entrepreneurs, Elon Musk — used a $465 million loan guarantee from the U.S. Department of Energy to develop a manufacturing facility to produce part of the popular Model S plug-in electric vehicle (United States Department of Energy Loan Programs Office, n.d.).

The government chose Tesla as part of its broader program of support for the electric vehicle industry, which includes tax incentives for electric car buyers. The loan helped Tesla at a critical moment and the company has since solidified its place as a leading firm in the electric vehicle sector worldwide.

This kind of intervention in the market goes against standard economic thinking that says that markets, if left alone, are efficient and have little need of government. Government intervention, according to this logic, is justified only for public goods such as infrastructure, education, and job training, or basic scientific research. The private sector will invest in retooling the plant for Tesla only if and when there is sufficient demand for electric vehicles.

In reality, the private sector wasn’t there to take the risk on Tesla, at least not alone. Many private sector interests continue to lobby government to prevent the rise of electric cars.

Without public sector leadership and investment, innovation-led growth would likely be restricted to a much narrower set of industries, issues, and beneficiaries.

Governments have the economies of scale to take the risks associated with nascent industries or unproven technologies, and to make investments that are too risky for the private sector alone. When they do, they effectively lower the risk in the longer term for business investors. These investors aren’t making their decisions based solely on low tax rates. They have an eye to future opportunities — opportunities that governments can help shape and direct with their own strategic investments.

Without public sector leadership and investment, innovation-led growth would likely be restricted to a much narrower set of industries, issues, and beneficiaries.

The U.S. government’s bet on Tesla may yet prove important in disrupting the fossil-fuel-consuming car industry of today, creating new opportunities for a future electric vehicle market and producing environmental benefits. Without public sector leadership and investment, innovation-led growth would likely be restricted to a much narrower set of industries, issues, and beneficiaries.

2. “Venture capital takes all the risk.”The wily and brilliant entrepreneur, tinkering with the next iPhone in his or her garage, is a pervasive trope. So, too, is the image of the risk-loving venture capitalist making savvy bets and cashing in on the next Google or Instagram when it goes public.

In fact, innovation emerges from complex ecosystems made up of diverse actors such as universities, government labs and research institutions, private sector firms, and private equity and venture capital. They interact in complex ways at different stages of the innovation process. This complexity can make it hard to tell the whole story behind an innovation or technological breakthrough. Too often, the role and timing of government investment is left out, overlooked, or purposefully downplayed.

According to Block and Keller (2011), 88 per cent of the most important innovations between 1971 and 2006 were dependent on federal research support in the United States. We often forget it was the U.S. Department of Defense, through its Defense Advanced Research Projects Agency (DARPA), that invented and commercialized the Internet.

Of late, many governments have focused on facilitating the venture capital sector to make their economies more innovative. It is, however, increasingly public venture finance — from big public development banks like the KfW in Germany or the Small Business Innovation Research (SBIR) program in the United States — that has been making investments in the early stages when risk of failure is high.

Governments, not venture capitalists, are better equipped to make patient and long-term investments that track technology development from the risky early stages through to the development and commercialization phases.

Governments, not venture capitalists, are better equipped to make patient and long-term investments that track technology development from the risky early stages through to the development and commercialization phases.

Governments, not venture capitalists, are better equipped to make patient and long-term investments that track technology development from the risky early stages through to the development and commercialization phases. “Venture capital funds are not providing the kind of patient long-term finance needed for radical innovations,” says Mazzucato. “They are too focused on a profitable exit’ — usually through an IPO or a sale to a bigger company — within 3–5 years. But innovation often takes 15–20 years.”

The venture capital and private equity industry certainly has an important role to play in economies fuelled by innovation. But so do governments, with their longer-term focus and economies of scale, and with a deep commitment to sustainable growth and equitable wealth creation. Their support is particularly important when it comes to the success of smaller companies that venture capitalists avoid because there is no promise of a big return.

The SBIR program in the United States is a case in point. It facilitates the absorption of new technology by small and medium-sized enterprises (SMEs) and provides up to $850,000 in early stage research and development (R&D) to small technology companies or entrepreneurs who have launched companies (Niosi, 2011, p.14). As venture capitalists have become more risk-averse and focused on opportunities for significant and quick payouts, the SBIR program has funded many innovations emerging from America’s small firms and start-ups.

Photo above by Norm Betts for Bloomberg / Getty Images

Realizing Innovation-Led Growth

While the world debates its merits, governments are actively and successfully investing in innovation — and in some surprising places.

United StatesThe United States may have a reputation as a free market haven, but the American government’s fingerprints are all over the country’s economic success.

From the innovations that gave us the iPhone to the algorithm that drove Google’s search engine, the U.S. government has played a pivotal role in the innovations that have established the country’s economic pre-eminence.

From the innovations that gave us the iPhone to the algorithm that drove Google’s search engine, the U.S. government has played a pivotal role in the innovations that have established the country’s economic pre-eminence.

From the innovations that gave us the iPhone to the algorithm that drove Google’s search engine, the U.S. government has played a pivotal role in the innovations that have established the country’s economic pre-eminence.

Innovations have emerged from, or have been supported predominantly by, the Department of Defense and other national security related agencies like the Defense Advanced Research Projects Agency (DARPA), the National Aeronautics and Space Administration (NASA), and the Atomic Energy Commission (AEC) (Weiss, 2014). But the U.S. government has been active in other ways, too, delivering nanotechnology breakthroughs through the National Nanotechnology Initiative (NNI), biotech innovations resulting from National Institute of Health (NIH) research initiatives, and pharmaceutical discoveries resulting from the Orphan Drug Act, to name just a few.

Interestingly, the Small Business Innovation Research (SBIR) program was initiated by one of the greatest political champions of free market enterprise, former president Ronald Reagan.iii SBIR now provides more than $2 billion per year “in direct support to high-tech firms, has fostered development of new enterprises, and has guided the commercialization of hundreds of new technologies from the laboratory to the market” (Mazzucato, 2013).

More recently, the United States government has invested heavily in renewable energy and advanced manufacturing, two other areas where it sees opportunity for global leadership:

1. The Advanced Research Projects Agency-Energy (ARPA-E). Modelled on the successful DARPA, ARPA-E directs funding to researchers developing transformational ways to generate, store, and use energy, while attempting to “catalyze cutting-edge areas of energy research.” Its ambition is to advance “high-potential, high-impact energy technologies that are too early for private-sector investment” (Advanced Research Projects Agency-Energy, n.d.).

The investments are risky. But the U.S government is betting that it will reap significant rewards as a major producer of the clean energy technologies of the future while creating the good green jobs that go with it.

2. Advanced Manufacturing Partnership. We’re told that American manufacturing is dead. Since the Great Recession, government has stepped in to dispel that myth. On June 24, 2011, U.S. President Barack Obama launched the Advanced Manufacturing Partnership (AMP), “a national effort bringing together industry, universities, the Federal Government, and other stakeholders to identify emerging technologies with the potential to create high-quality domestic manufacturing jobs and enhance U.S. global competitiveness” (Executive Office of the President, 2012).

Since then, Obama has reiterated his priority to make the United States a magnet for new jobs and manufacturing (Advanced Manufacturing Portal, n.d.). He has proposed building 15 regional innovation hubs “to accelerate development and adoption of cutting-edge manufacturing technologies,” for example. Four of these hubs, including the Digital Manufacturing and Design Innovation Institute (DMDI) in Illinois, have already launched, and four more are on their way.

To “sow the seeds for tomorrow’s breakthroughs,” the White House has committed to developing “technology testbeds” within federal research facilities. Companies can design, prototype, and test new products and processes in these spaces (Pritzker and Zients, 2014). At the recommendation of his Council of Advisors on Science and Technology (Executive Office of the President, 2014), the president recently committed to a number of ambitious strategies, including a $300 million investment in three technologies deemed critical to manufacturing competitiveness.

China and GermanyThere is growing recognition that governments have a critical role to play in creating a green and sustainable economy (Organisation for Economic Co-operation and Development (OECD), 2014; Green European Foundation, 2013; E3G, n.d.). Germany’s aggressive push to transition to renewables leaves many other countries behind, including Canada. Can government policies help explain the emergence of Germany and even China as leaders in green technology and innovation?

In addition to investing heavily in research and development, both China and Germany have established successful, publicly financed development banks. The China Development Bank (CDB) and Germany’s KfW have been instrumental in providing financing for renewable energy projects and green technology manufacturers. They have also both used feed-in tariffs to encourage investment in renewable energy technologies, and to help establish stable markets for their wind and solar industries.

As Ciuriak and Curtis (2013) note, Germany’s strength in innovation is attributable to a mix of direct and indirect government support, including a “network of quasi-public research institutes, such as the Fraunhofer Society, that support innovation, the training and apprenticeship system, and patient finance from banks with close ties to the industrial sector.”

Germany already produces about a quarter of its energy from renewables. On a sunny or windy day, it can power almost the entire country with renewable energy (Kroh, 2014). As part of its ambitious energy transition plan, called Energiewende, the country expects to generate that much power every day (E3G, n.d.).

We hear a lot about China’s dependence on dirty coal, but there, too, government has shown vision and leadership as its green technologies are developed. In its current five-year industrial strategy (2011–2015), China is investing $1.5 trillion, or more than five per cent of its GDP, in a variety of green industries. Priorities include alternative energy, biotechnology, new-generation information technology, high-end equipment manufacturing, advanced materials, alternative fuel cars, energy saving, and environmental protection (China Dialogue, 2011; Mazzucato, 2013). This approach involves massive public investment, both direct and indirect, in green industries and businesses, but also investment in scientific development and education through support for research institutions and universities.

China’s target for domestic wind — 1,000 GWs by 2050 — equals the entire electric capacity of the United States. Its targets for solar power generation — 20 GWs by 2015 — are equally ambitious, if not staggeringly hopeful. The China Development Bank has been a key source of financing for solar and wind manufacturers with plans for expansion (Mazzucato, 2013).

Considering Canada

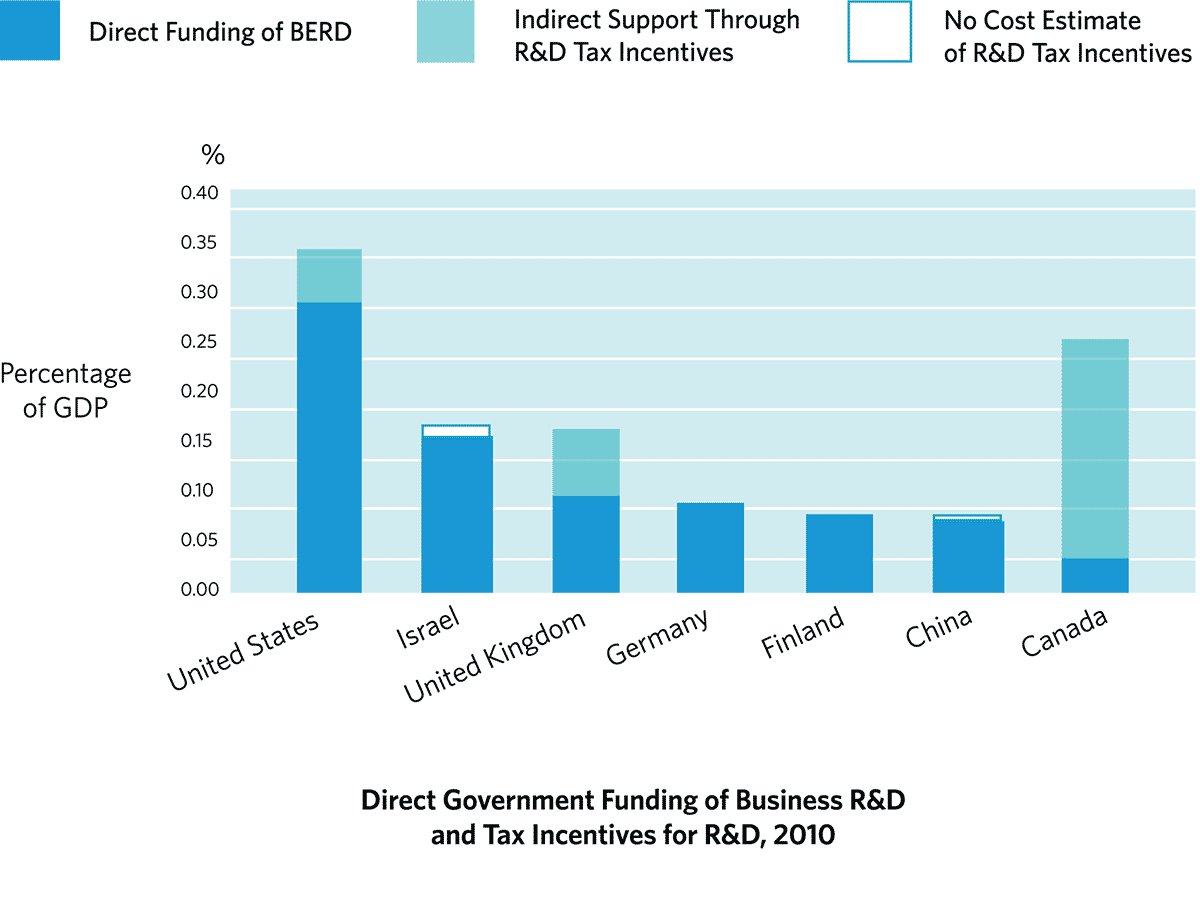

Unlike in other countries, the majority of public support for industrial research and development in Canada today is provided through tax credits rather than direct investment.

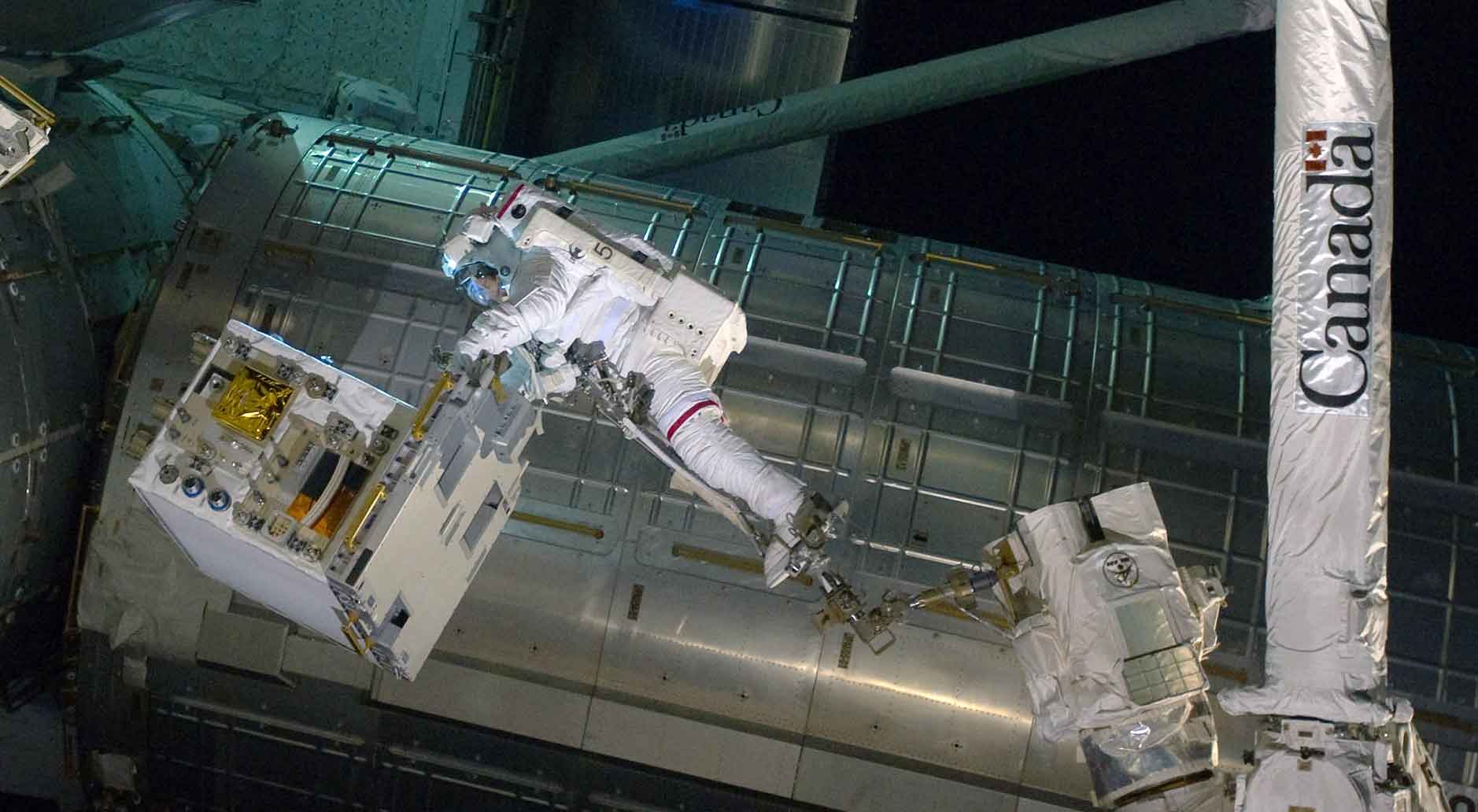

The Canadian government, however, has historically engaged in a range of successful policies and targeted strategies to drive innovation and economic growth. There are iconic examples, led by government, that many Canadians would recognize — the Canadian Space Agency’s Canadarm or the controversial supersonic aircraft, the Avro Arrow, for instance. Even the initial building of Canada’s railroad and telecommunication networks can be thought of as government investments in innovation.

The Canadian narrative is filled out by current examples of government leading or supporting innovation. These examples also point to key deficiencies — such as patchwork federal funding and “paradoxical” research capacity — and prompt questions:

The patchwork of federal government support. Much of Canada’s support for innovation happens through the National Research Council’s Industrial Research Assistance Program (IRAP) (National Research Council, n.d.; Niosi, 2011). From 1996 to 2006, IRAP administered Technology Partnerships Canada (TPC), a program that provided more than $3 billion in financial support to companies to undertake early stage R&D and to develop Canadian technological capacities (Industry Canada, 2014).iv

TPC helped cement Canada’s internationally competitive aerospace industry (the fourth largest in the world), where Canada leads in areas such as aircraft engines, landing gear, and regional aircraft production. Innovative corporations that received TPC funding include the civil and military aviation firm CAE Inc., a world leader in flight modelling, training, and simulation, and Bombardier (Ibid.). Of course, it was the sale of the publicly owned airline, Canadair, to Bombardier, that facilitated Bombardier’s entry into the aerospace and defence sector in the first place (Ciuriak and Curtis, 2013).v

Another major recipient of federal funds was Pratt and Whitney. TPC supported its development of engines for the world’s first commercial passenger spaceship, SpaceShipTwo (SS2) (Industry Canada, n.d.b.).

When it still had an active mandate, TPC supported innovative breakthroughs by pharmaceutical companies. For example, Calgary-based SemBioSys Genetics Inc. has turned safflower plant seeds into a bioequivalent to human insulin and established one of the most technically advanced R&D facilities for plant-made pharmaceuticals in the world (Industry Canada, n.d.c).

While pharmaceutical and aerospace companies made up the majority of TPC funding recipients, many high-tech firms such as IBM Canada, QNX, and Research in Motion (RIM), now known as BlackBerry, also received funding. In fact, between 1998 and 2000, RIM received more than $39 million from TPC (Industry Canada, 2014). This investment came at a critical time of innovation and growth for the company, preceding a decade during which RIM would become a global leader in mobile technology and the largest smartphone maker in the world.vi

RIM’s massive investments in R&D in the decades since have benefited from the government’s enormous investments and indirect support for innovation through the Scientific Research and Experimental Development (SR&ED) tax incentive program. This program, which allows firms to write off part of their research costs, represents Canada’s biggest ($3.3 billion in 2012) federal tax expenditure for innovation.

The paradox of Canada’s R&D capacity. It’s no secret that Canada trails its peers internationally in key innovation indicators, including research and development (R&D) spending (OECD, 2014; Council of Canadian Academies, 2013b; Review of Federal Support to Research and Development, 2011). The disconnection between Canada’s excellence in university-centred research and its weakness in business innovation (Council of Canadian Academies, 2013a) has been called the “Canadian Paradox.”

According to a recent OECD report, Canada invested less in R&D in 2012 than back in 2004, and countries that it outspent only a decade ago — Russia, India, Taiwan, and Brazil — have now all surpassed it (OECD, 2014; McKenna, 2014). Canada’s R&D spending as a percentage of GDP (also known as R&D “intensity”) has also declined significantly. At less than 1.7 per cent of GDP, it is well below the OECD average of 2.4 per cent and the admirable 2.8 per cent in the United States and 2.98 per cent in Germany.

Canada’s business spending on R&D (BERD) is also low and decreased steadily from 1.26 per cent of GDP in 2001 to 0.88 per cent in 2012, giving Canada a rank near the very bottom of OECD countries (Ibid). This comparatively low BERD spending is the result of the relative decline of Canadian manufacturing compared to natural resources, as highly R&D-intensive manufacturing industries now make up a relatively small share of Canada’s economy (Council of Canadian Academies, 2013a, 2013b; Niosi, 2011).

Some say the innovation lag is due to a government approach that is overly reliant on indirect supports such as tax subsidies and incentives. In a report to the federal government in 2011 entitled Review of Federal Support to Research and Development, an expert advisory panel underlined the need to rethink and revamp Canadian innovation policy entirely. It highlighted that the Canadian government currently spends the bulk of its funding on indirect incentives that simply aren’t doing the trick.vii

“Government needs to do a better job helping our innovative SMEs grow into larger, world-competitive companies in Canada. Relative to the size of the Canadian economy, government support for business R&D in Canada is among the most generous in the world, yet we’re near the bottom of the pack when it comes to seeing business R&D investment.”

“Government needs to do a better job helping our innovative SMEs grow into larger, world-competitive companies in Canada. Relative to the size of the Canadian economy, government support for business R&D in Canada is among the most generous in the world, yet we’re near the bottom of the pack when it comes to seeing business R&D investment.”

“Government needs to do a better job helping our innovative SMEs grow into larger, world-competitive companies in Canada. Relative to the size of the Canadian economy, government support for business R&D in Canada is among the most generous in the world, yet we’re near the bottom of the pack when it comes to seeing business R&D investment,” says panel chair Tom Jenkins.

Canada is an outlier internationally when its method of allocating R&D funding is compared to others.

The report called for various reforms, emphasizing that direct government support mechanisms are generally more effective at spurring innovation. It also offered a series of other far-reaching recommendations, including the need to provide more risk capital to innovative firms.viii

Canada’s 2013 and 2014 budgets did introduce encouraging new measures to boost business innovation. Some $400 million, for example, was earmarked for risk-sharing with various venture capital funds through the Business Development Bank of Canada (BDC) to increase private sector investment in early stage risk capital (Government of Canada, 2013). The government extended stable funding to the Strategic Aerospace and Defence Initiative (the replacement program for the TPC) and the Technology Demonstration Program, both examples of more direct approaches to supporting business innovation.

The question remains whether these efforts are adequate to keep pace with the world’s innovation leaders and their ambitious and direct support for innovation.

Photo above by NASA / Getty Images

Re-Setting Expectations

A growing body of evidence, and the analyses of scholars like Mazzucato, is starting to open our eyes to the true value of government participation in innovation strategies.

Mazzucato raises concerns that the roles of public and private sectors in countries like Canada are becoming increasingly out of balance, with the “parasitic” private sector capturing most of the benefits of public sector investments, but not adequately reinvesting to fund new waves of innovation. She characterizes a system where the risks are socialized and the rewards privatized.

Many economists argue that the private sector gives back through paying its taxes (corporate income tax, capital gains, etc.), a share that is determined by government.

In Canada, corporate tax rates have been cut almost in half, dropping from 28 per cent in 2000 to 15 per cent today (Canadian Labour Congress, 2013). Capital gains are taxed at only 50 per cent of wages and salaries. Meanwhile, Canadian corporations have racked up more than $600 billion on their balance sheets — the fastest accumulation in any G7 country since the mid-2000s (International Monetary Fund, 2014). The accumulation of “dead money” means corporations have not reinvested in machinery, human capital, or the R&D needed to foster innovation.

Tax evasion and the exploitation of tax loopholes also means many Canadian companies are paying even less tax than they truly owe. Canadian Business magazine conducted an investigation into the disturbing and widespread abuse of legal tax loopholes by Canadian corporations (Hood, 2014). It found, for example, that “Canadian Pacific Railway paid an average effective cash tax rate of just 1.8% over the past decade, Manitoba Telecom paid 4.1%, Gildan Activewear paid 5.5%, and First Capital Realty has gone for years without paying any cash taxes at all.”

Beyond the tax system, many corporations also choose to promote share buybacks that direct surplus cash to shareholders instead of reinvesting in priorities that could spur further innovation.

If tax systems aren’t working in a way that promotes inclusive growth, and reform is difficult, Mazzucato suggests government consider a “revolving fund” whereby the wins from its risk-taking can fund the losses.

This could mean government loans and grants would not come without strings attached. For example, they could include local procurement or local hiring requirements. Loans could also be income contingent, or required to be repaid when a company makes profits above a certain threshold. To the Canadian government’s credit, this is the approach Technology Partnerships Canada (TPC) and its successor, the Strategic Aerospace and Defence Initiative, adopted. Their rates of recuperation to date, however, have been unacceptable.

Finally, governments might also consider retaining equity positions in the companies that they support through their state investment banks — a common practice of both the China Development Bank and the KfW in Germany.

Creating Wealth and Wellbeing for More Canadians

There is a lot at stake in this conversation about public investment in innovation. Our future prosperity and health depends in large measure on how well Canada performs as an innovator.

How will governments rise to the challenges of a highly competitive global marketplace and growing income and wealth inequality? What can be done to continue changing perceptions about who should take and benefit from risks? How do we begin to articulate a clear, common agenda for smart, equitable, and innovation-led economic growth?

We propose these questions as a starting point:

- What kind of innovator do we want Canada to be?

What kind of investors do our governments need to be? - What’s working now — in Canada and around the world — that shows the way forward?

- What’s needed, at what cost, for what — and for whose — benefit?

- Who’s ready to move in this direction?

- What are the first steps we must take together, and what can each of us do on our own?

Only a different conversation about government’s role in innovation will create a new narrative — one in which Canada is reaching its full potential as a leading investor in the wealth and wellbeing of all its citizens.

Photo above by Nancy D. Regan / CC BY-NC 2.0

The Atkinson Foundation promotes social and economic justice by investing in people who are making Ontario more equitable, inclusive and prosperous.

The Atkinson Foundation promotes social and economic justice by investing in people who are making Ontario more equitable, inclusive and prosperous.

The Broadbent Institute is an independent, nonpartisan organization championing progressive change through the promotion of democracy, equality, and sustainability and the training of a new generation of leaders.

The Broadbent Institute is an independent, nonpartisan organization championing progressive change through the promotion of democracy, equality, and sustainability and the training of a new generation of leaders.

The author of this background paper is Jonathan Sas, the Director of Research at the Broadbent Institute. He holds an M.A. in political science from the University of British Columbia. He would like to thank Alex Himelfarb, Andrew Jackson, David Wolfe and Armine Yalnizyan for reading earlier versions and providing helpful feedback.

© 2015–2024, More Courageous Bets and Equitable Returns by the Broadbent Institute for the Atkinson Foundation is licensed under a Creative Commons Attribution 4.0 International License. To view a copy of this license, visit https://creativecommons.org/licenses/by/4.0/